The global photovoltaic (PV) solar industry is entering a critical cost inflection point. A combination of rapidly rising raw material prices, sharp increases in lithium carbonate costs, and China’s upcoming cancellation of export VAT rebates starting in April is fundamentally reshaping pricing dynamics across the entire supply chain.

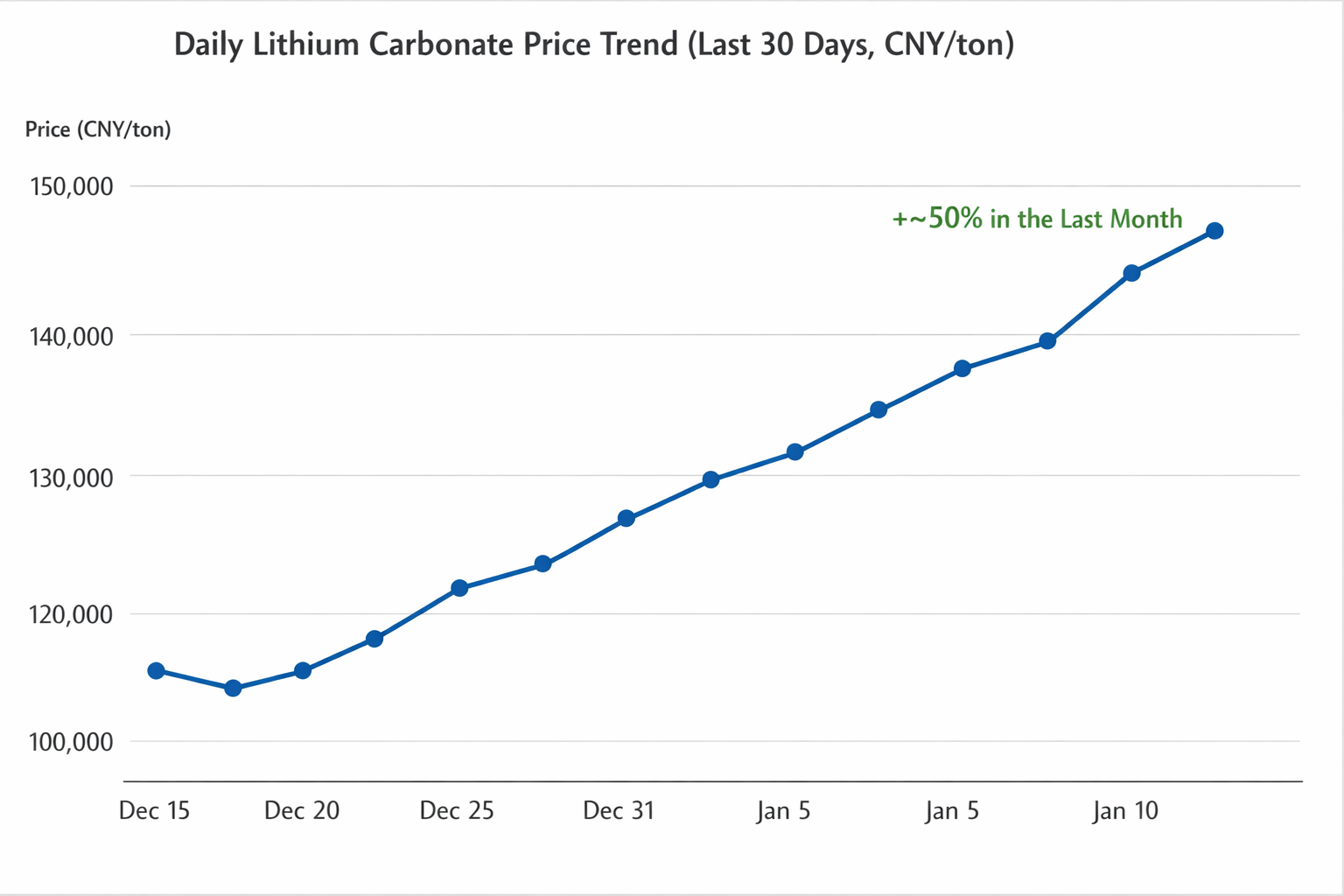

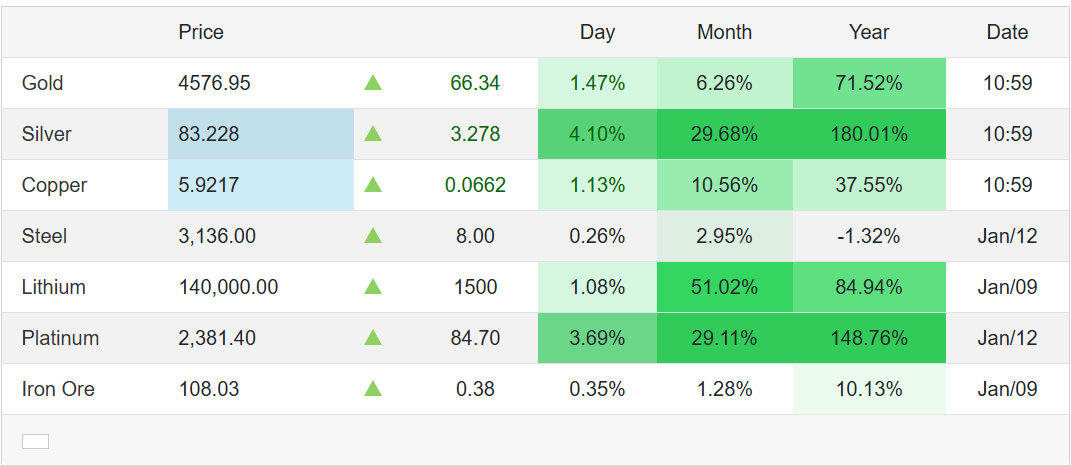

Over the past several weeks, multiple upstream materials essential to PV systems have shown accelerated price increases.

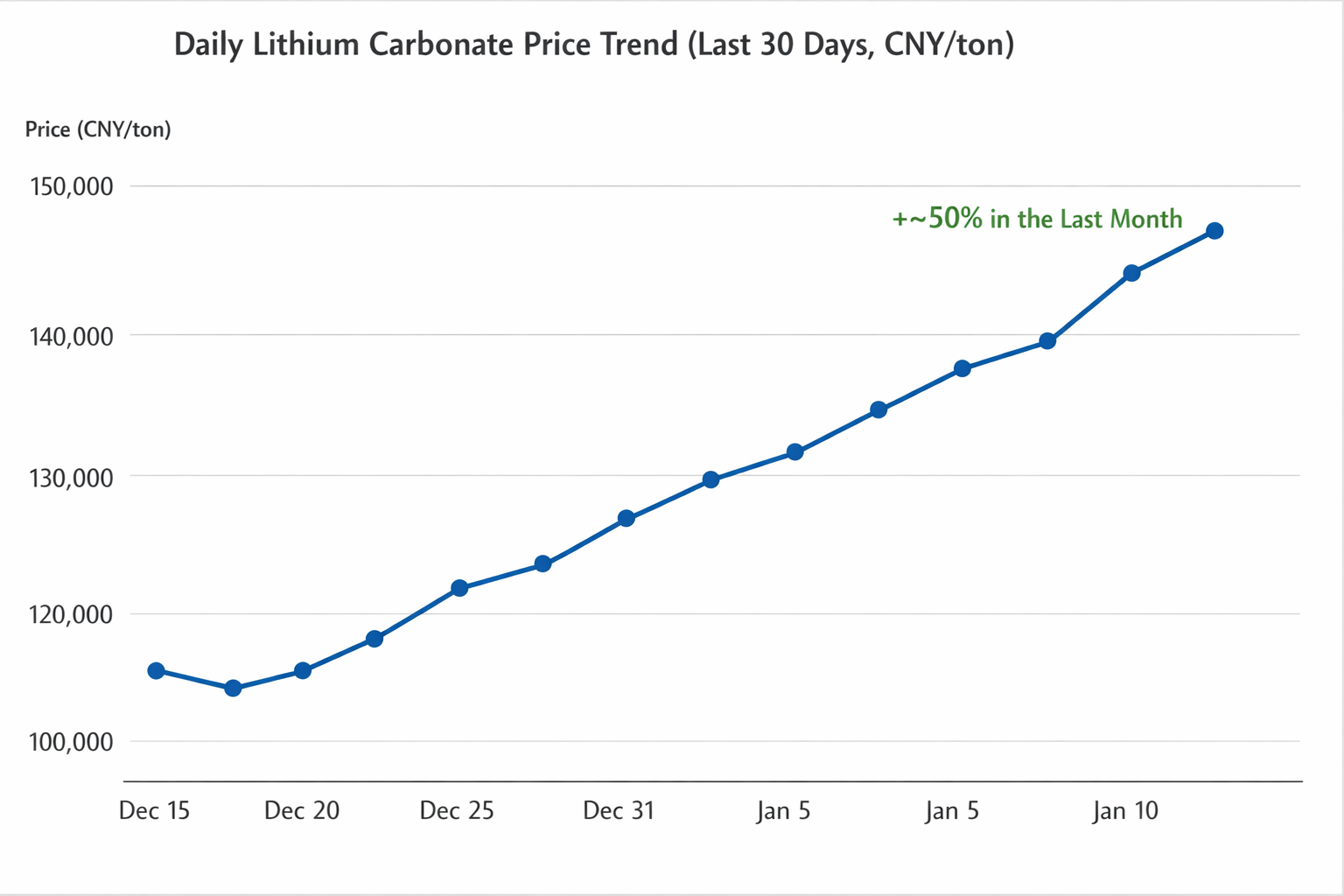

Lithium carbonate prices have rebounded aggressively due to low inventories, policy-driven demand expectations, and continued growth in battery demand from energy storage and EV sectors. This directly increases costs for PV plus storage systems.

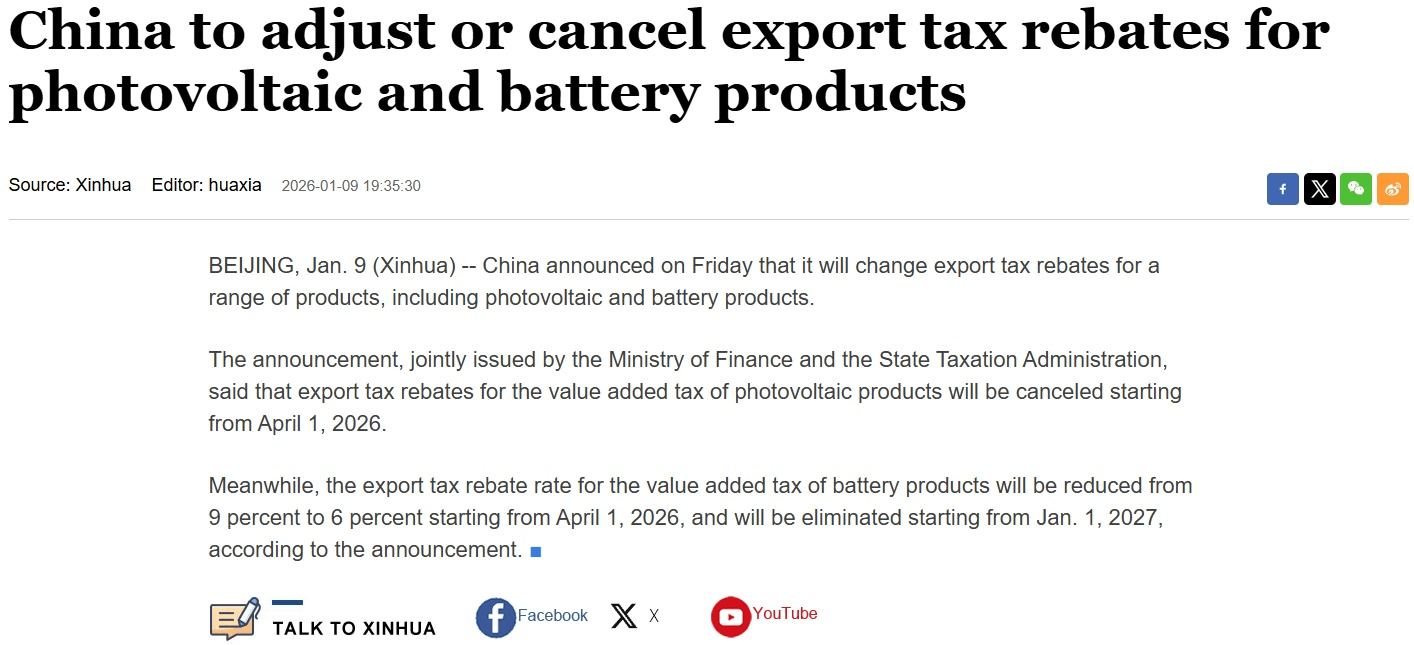

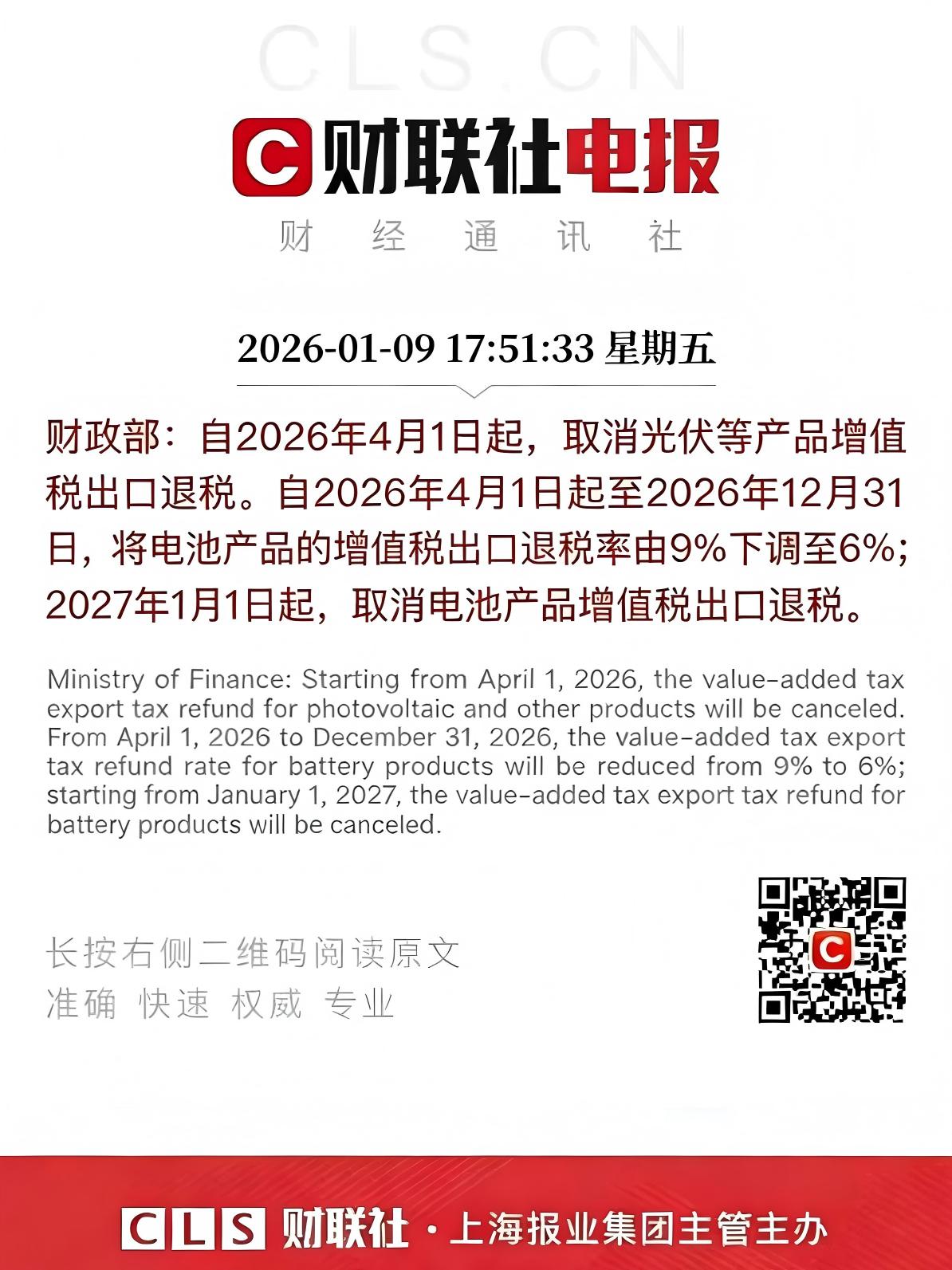

China will cancel export VAT rebates for photovoltaic products starting in April, with lithium battery rebates being phased out.

This represents a structural cost increase for exported PV and energy storage products, pushing manufacturers to raise prices and accelerate shipments ahead of implementation.

The convergence of raw material inflation and policy changes is narrowing procurement windows.

*Delayed purchasing now carries higher cost risk.

*Early orders help lock in pricing and secure supply.